First Class Tips About How To Claim Capital Cost Allowance

The cca claim for the following year is based on the remaining balance of the property’s.

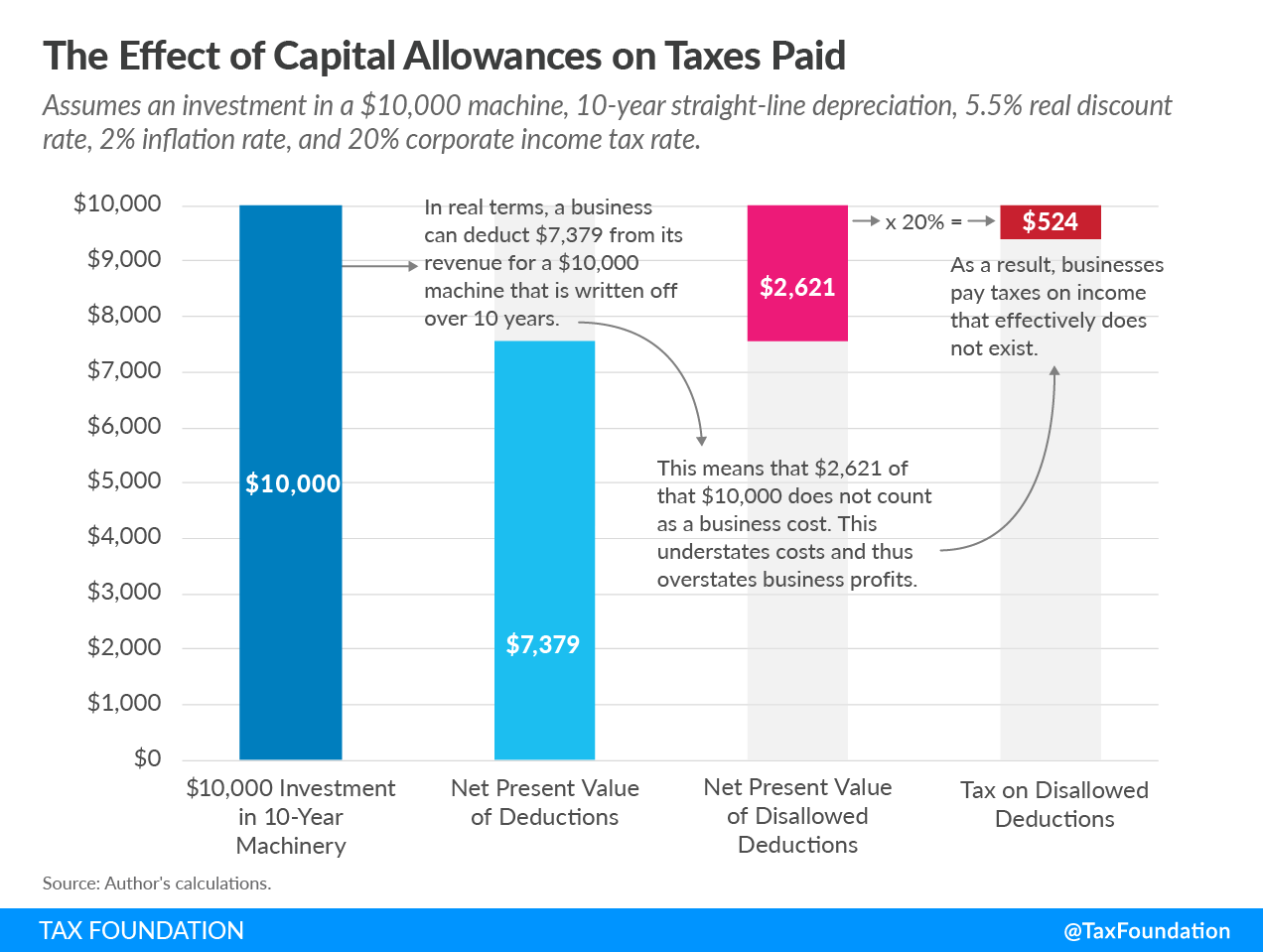

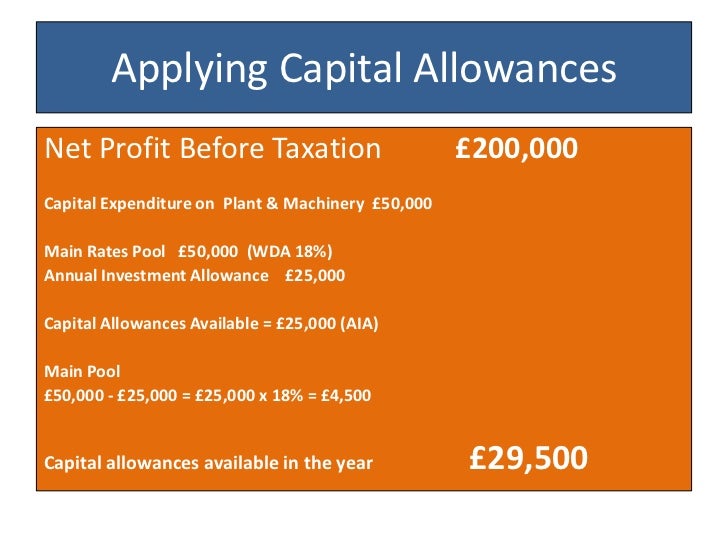

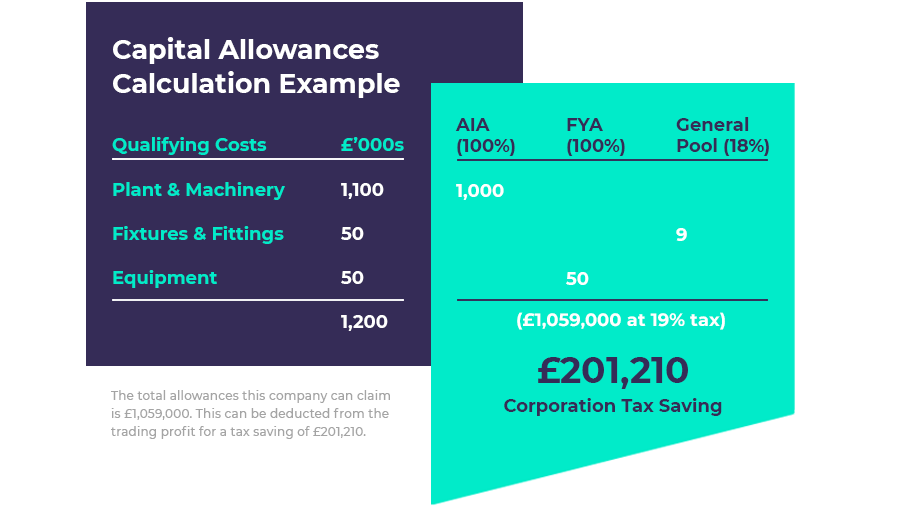

How to claim capital cost allowance. Capital allowances can typically be claimed on capital expenditure for tangible and intangible assets, including equipment, vehicles, property, research and. The law however provides for corresponding deductions on expenditure incurred on certain assets used for the purpose of the business in the form of industrial building allowance,. They let you deduct some or all of the value of an item from your profits before you pay tax.

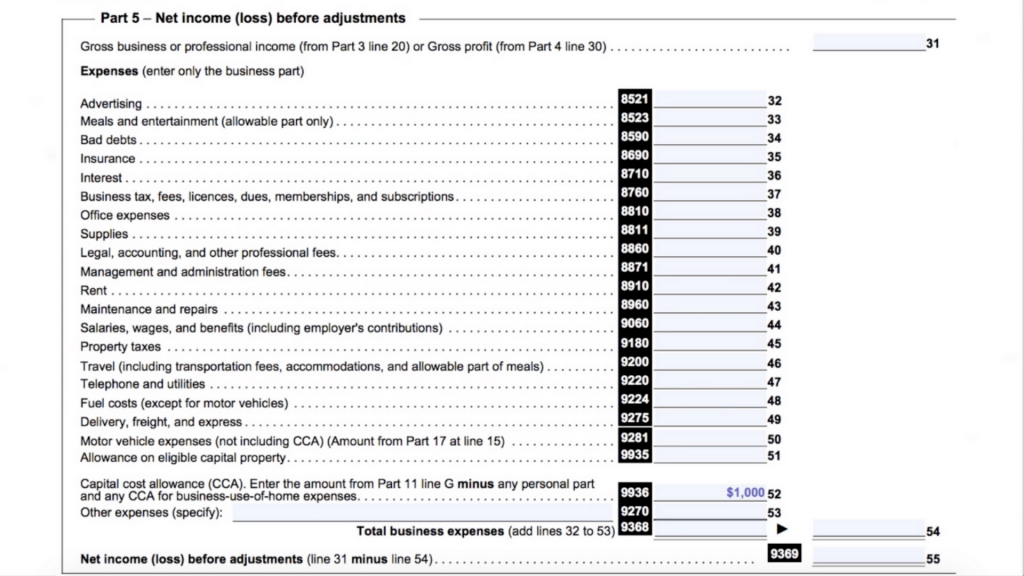

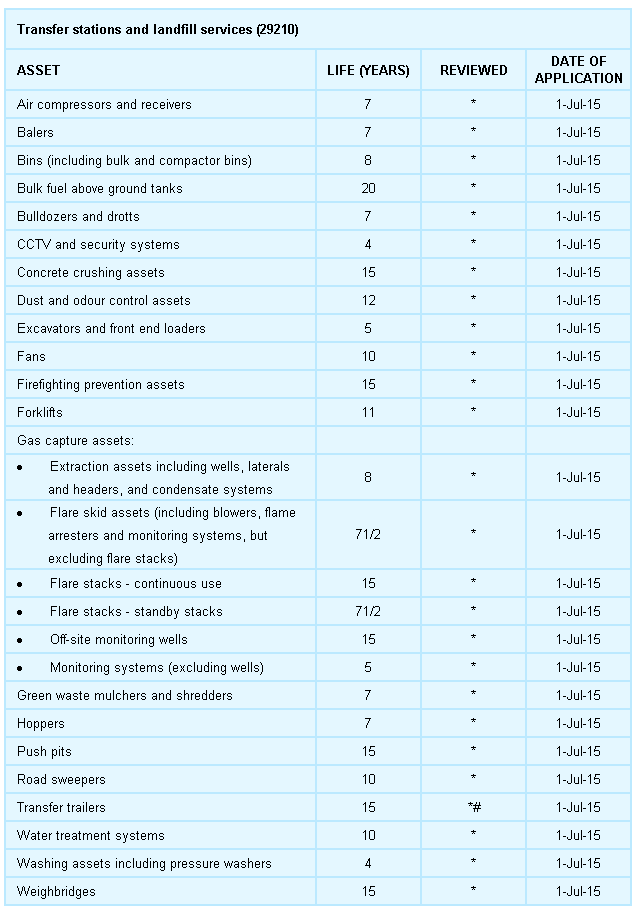

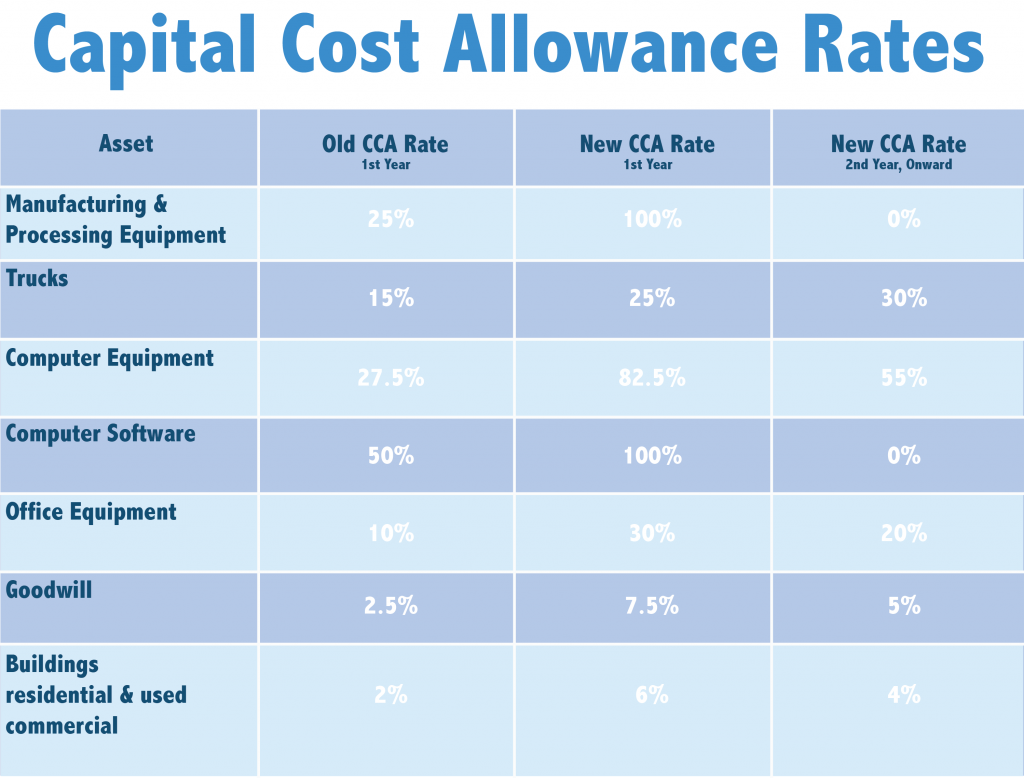

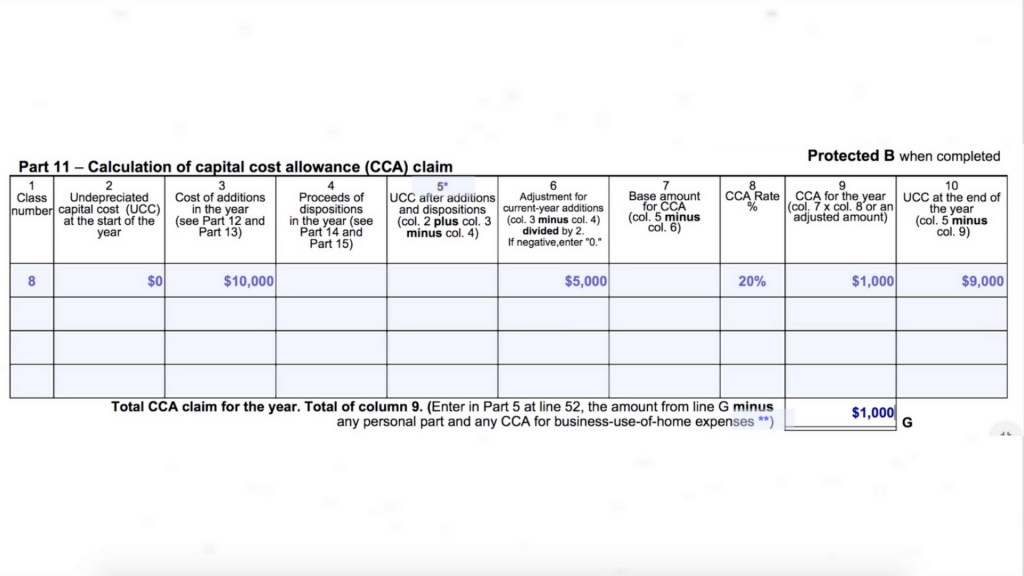

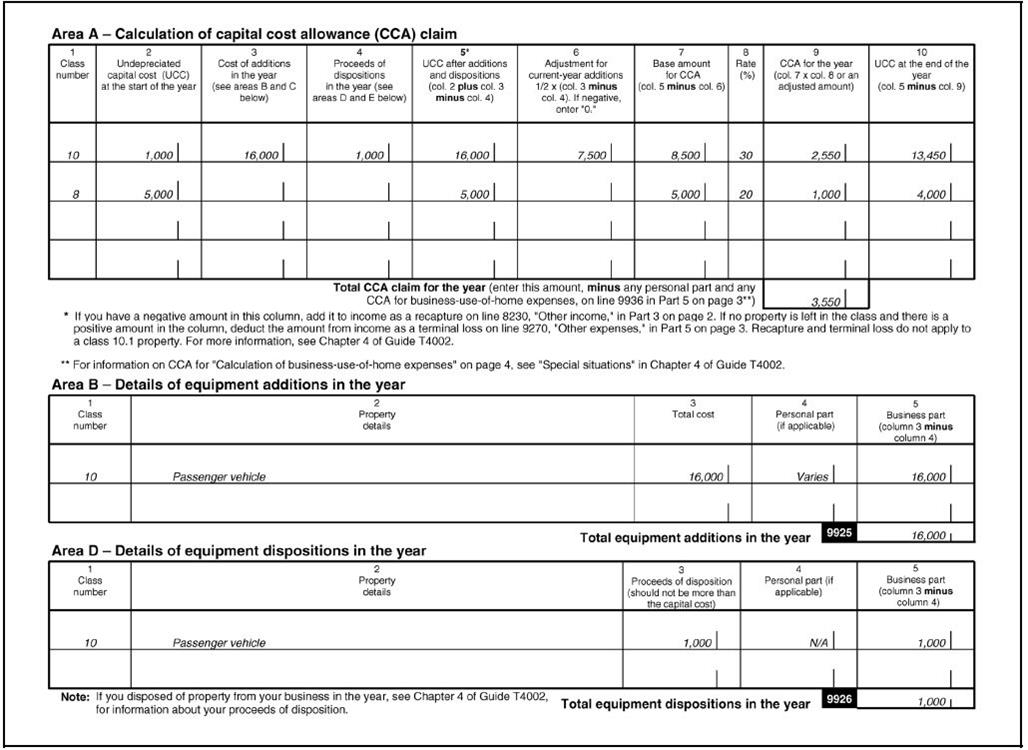

Depreciation of buildings. Calculate your cca using the rules discussed in how to calculate the deduction for capital cost. The capital cost allowance you can claim depends on the type of property you own and the date you acquired it.

Basic information about capital cost allowance (cca) current or. Claiming capital allowances means you can deduct part or all of the asset’s value from your profits. How to claim overview capital allowances are a type of tax relief for businesses.

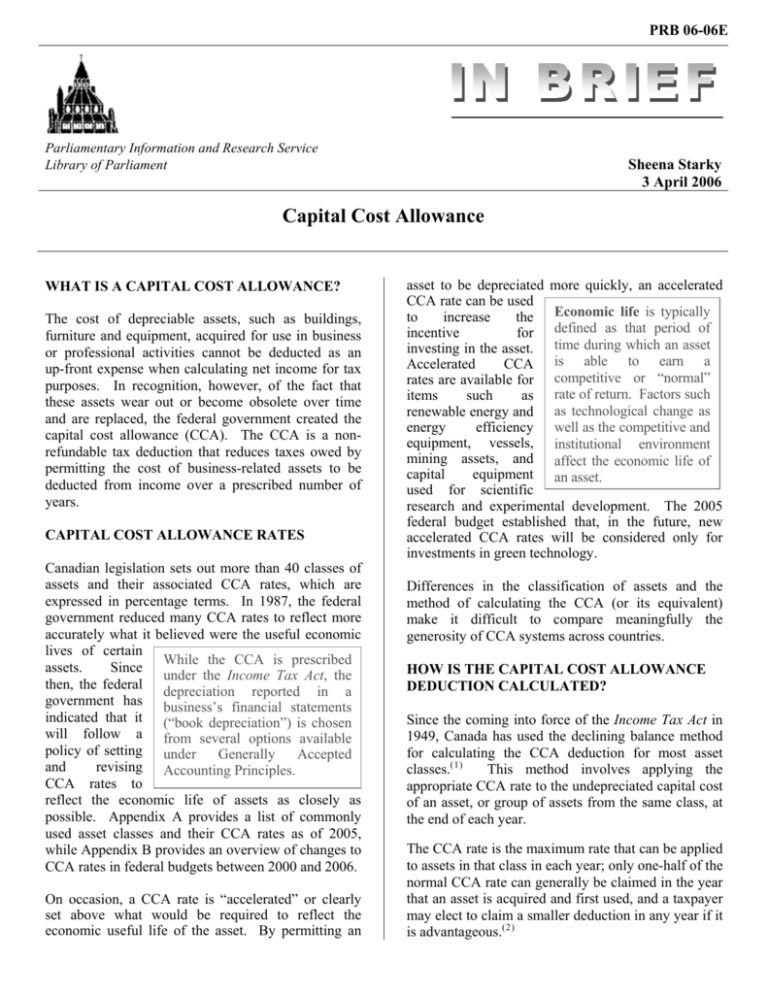

The capital cost allowance (cca) is an annual deduction in the canadian income tax code that can be claimed on depreciable assets when figuring taxable income. General depreciation rules set the amounts (capital allowances) that can be claimed based on the asset's effective life. Start filing what is capital cost allowance (cca) ?

Temporary full expensing you may be able to claim. So what, exactly, is capital cost allowance and how does it help small businesses and real estate. The amount you can claim is deducted from your profits.

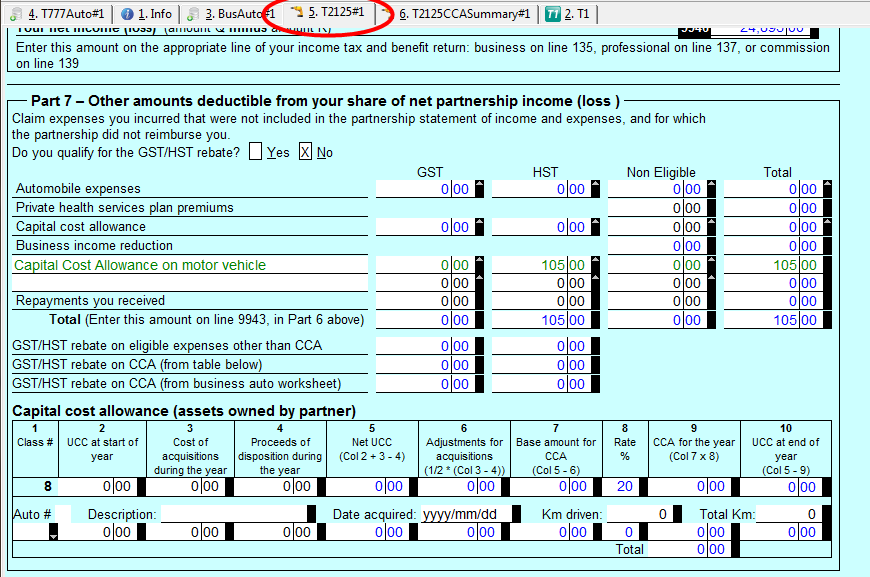

The capital cost allowance is a tax deduction based on the depreciating value of a business asset. If you are an employee earning commission income, you can claim cca on your vehicle if you meet the. Using it reduces the taxable income on your tax return.

Assume the property was purchased for $100,000 and a cca of $1,000 is claimed. Capital cost allowance (cca) allows canadian businesses to annually claim depreciation expenses for capital assets under the. Buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital.

There are a few methods for calculating capital allowances. Acquiring an asset example 2: You must claim in the accounting period you bought the item if you want to claim:

Claimed as a percentage of the asset's cost over a number of years, the cca is typically allowed for purchases that are expected to last for several. How to calculate capital cost allowance capital cost allowance calculator capital cost allowance example example 1: If your fiscal period is less than 365 days, you have to prorate your cca claim.

You group the depreciable property you own into cra classes. How to calculate the deduction for capital cost allowance (cca) how much and how to calculate cca.