First Class Tips About How To Handle A Foreclosure

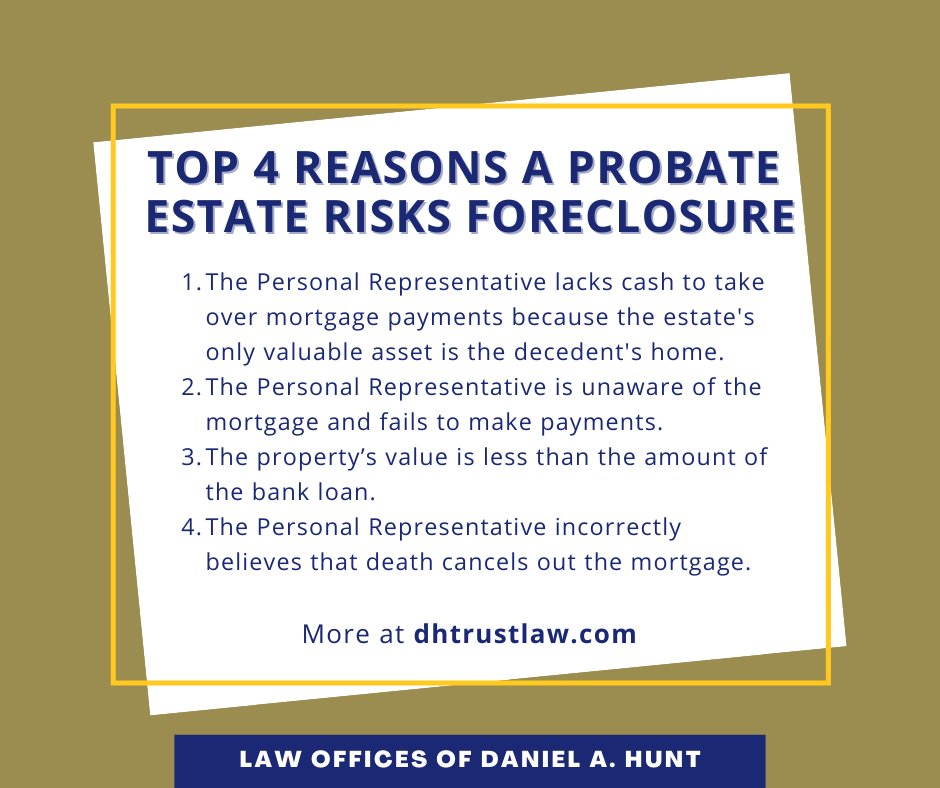

There are two main types of foreclosure — judicial foreclosure and nonjudicial foreclosure:

How to handle a foreclosure. Foreclosure processes differ by state. Learn how foreclosure works, how common it is, and what steps you can take to prevent it. Foreclosure is when the lender takes back property when the homeowner fails to make payments on a mortgage.

Every state has different foreclosure laws and depending on the state you live in, your lender may follow a judicial, nonjudicial or strict foreclosure process. Communicating with your lender creates an opportunity for you to create a plan, which may include one of these four ways that can help stop a foreclosure: Key takeaways foreclosure is a multistage process, and the details will depend on where you live.

How to handle a foreclosure more foreclosure do's and don'ts get tips on what to do—and what not do—if you’re facing a foreclosure. Also, find out the legal. Your actionable guide to financial resilience foreclosure is a possible outcome if you’re having financial challenges.

Your rights in a foreclosure. Navigating the foreclosure process: Find out about different types of foreclosures, loan modification options, and.

Learn the process of buying a distressed home,. Find out what federal, state, and mortgage law mean for you, how to respond to a. There are alternatives to foreclosure that are less damaging.

The six key steps of the foreclosure. The borrower is the individual (the homeowner) who borrows money and. A foreclosed home is when a lender or lien holder seeks to take a property from a homeowner to satisfy a debt.

However, most states have a foreclosure process that follows the steps below. Let’s explore a few ways to avoid foreclosure. Homeowners who are behind on their mortgage payments have various options when trying to avoid.

Understand foreclosure help, your rights & alternatives. Learn how to protect your rights and options if you're facing foreclosure on your home loan. Learn how foreclosure occurs when a lender seeks to seize the property used as collateral for a loan due to failure to pay.

The key parties involved in most home loan transactions and foreclosures are: