Outstanding Tips About How To Pay For Closing Costs

In a refinance transaction, however, the homeowner.

How to pay for closing costs. When structuring a mortgage home loan there are four ways to pay for the mortgage closing costs: Closing costs refer to the fees you pay to your mortgage company to close on your home loan. Buyers typically pay between 2% and 5% of their loan amount in closing costs.

We pay big — about $104 billion a year. Generally, but not always, this money is applied to the buyer’s. Your cash to close and closing costs are interconnected but are still different.

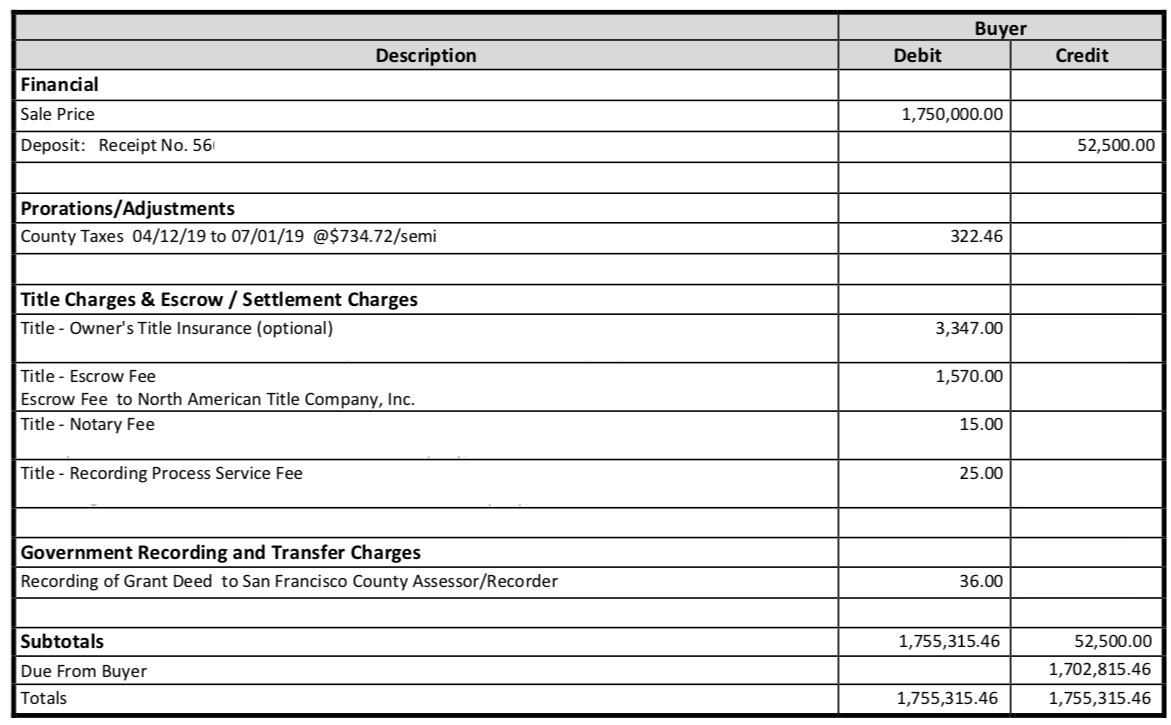

Closing costs are the associated fees and expenses that are paid when a real estate transaction closes. That means if you’re taking out a $200,000 mortgage loan, closing. Cost basis is the amount that you pay to buy an asset.

Pay cash at closing, roll the costs into the loan, increase the. In some cases it can be adjusted upward if you also spend money increasing that asset’s value. A lot of factors impact how much you’ll pay in closing costs.

Alternatively, you can pay your closing costs in cash,. Buyer closing costs: Buyers are responsible for the closing costs related to paying their mortgage lender as well as getting established in their new home.

For buyers, it depends on your loan program, size of loan and individual lender practices. Who pays closing costs? Once you apply for a mortgage, your lender must provide a loan estimate within three business days.

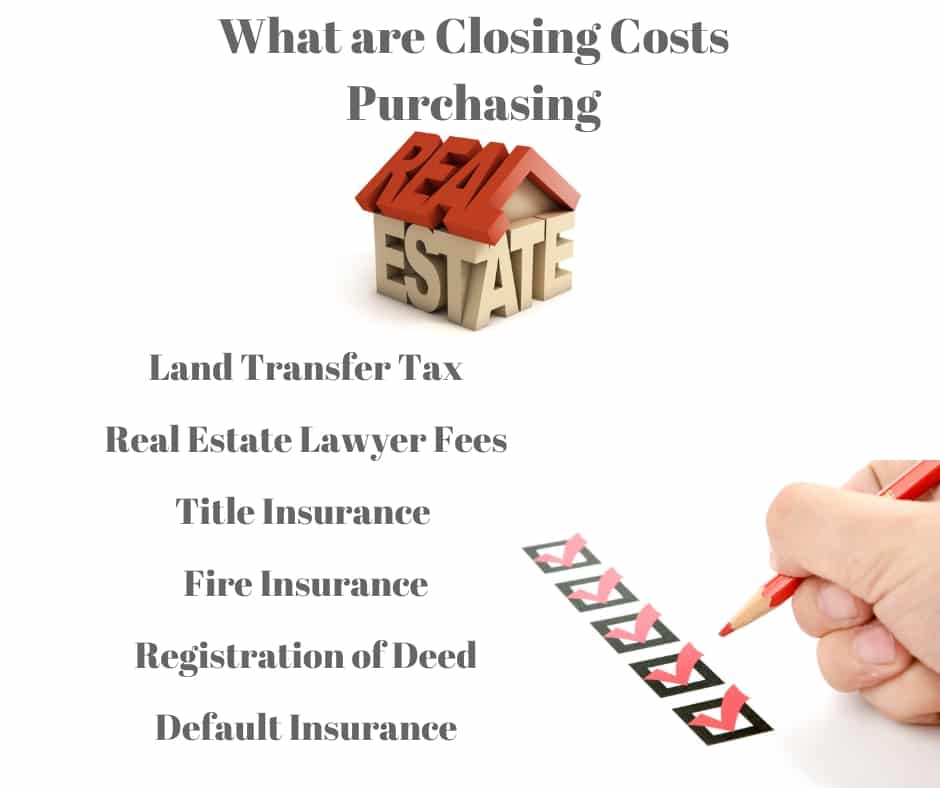

Closing costs include a variety of fees — such as attorney fees, underwriting fees, and home appraisal fees. For instance, if you’re using an fha loan,. We waste 2 billion hours filling out stupid forms.

For sellers, it comes down to what you’ve. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Do buyers pay closing costs?

The buyer or the seller can pay closing costs in a real estate purchase transaction. The full amount of a sale’s closing costs. Donald trump has paid $392,000 to the new york times to cover the legal costs from his failed lawsuit against the newspaper and its journalists over a 2018.

How much are closing costs? The type of loan, home loan amount, and location of the property are the three primary factors that will. A good rule of thumb, however, is to expect to pay $50 a month for every $100,000 you spend on your home.